Make Smarter, Faster, and Secure Lending Decisions with AI

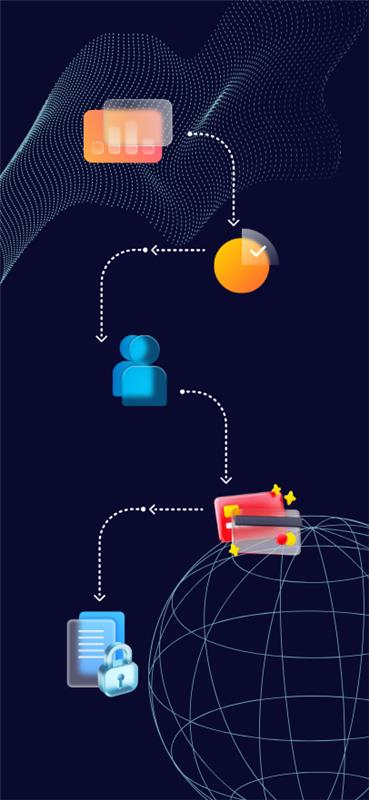

How It Works

Identity Verification

• Extract & validate Aadhaar, PAN, and ID details via OCR and live APIs.

• Assess identity risk: Low (full match), Medium (partial), High (mismatch).

• Assess identity risk: Low (full match), Medium (partial), High (mismatch).

Repayment Capability Check

• Analyze salary slips, bank statements, Form 16, and ITR for income consistency.

• Cross-verify names and salary data across documents to detect discrepancies.

• Cross-verify names and salary data across documents to detect discrepancies.

Security & Collateral Assessment

• Extract data from Registry, 7/12 Extract, FD Certificates, and more.

Risk Categories Based on Security Value vs Loan Amount

Surplus Security → Low Risk

Balanced Security → Medium Risk

Insufficient Security → High Risk

Balanced Security → Medium Risk

Insufficient Security → High Risk

AI-Powered Risk Scoring

• Built on extensive historical lending data for accurate risk scoring.

• Evaluates 30+ features: Loan amount, tenure, income, occupation, age, overdue history, and more.

• Outputs a risk probability score to classify applications into:- Low Risk – Auto-approve

Medium Risk – Flag for review

High Risk – Recommend rejection

• Evaluates 30+ features: Loan amount, tenure, income, occupation, age, overdue history, and more.

• Outputs a risk probability score to classify applications into:- Low Risk – Auto-approve

Medium Risk – Flag for review

High Risk – Recommend rejection

Key Benefits

Faster Approvals

Reduce decision time from days to minutes.

Reduced NPAs

Predict defaults early with behavioural and document-based insights.

Automated Underwriting

AI supports credit officers with real-time risk assessment.

Dual-Mode Lending

Works for both secured and unsecured loans.

Dynamic Risk Monitoring

Post-disbursement tracking with early warning alerts.

Built for Enterprise Lending

- Pre-Disbursement : Risk scoring, early fraud detection, smart triage.

- Post-Disbursement : Behavioral monitoring, re-scoring, portfolio risk analytics.

- Scalable Architecture: Modular design for integration with core banking and CRM systems.

- Audit-Ready : Full traceability of decisions, document trails, and model inputs.

Use Cases Across Roles & Industries

Banks & NBFCs

Automate loan underwriting while maintaining compliance.

Cooperative Banks

Modernize legacy processes with document + data intelligence.

Corporate Finance Teams

Evaluate employee or vendor loan eligibility instantly.

Fintechs

Scale digital lending with AI-driven credit decisions.

Microfinance Institutions

Assess risk for low-income borrowers using alternative data.